Accruals Definition, How They Work, and Pros & Cons

5K

Still, caution should be used, as there is still leeway for number distortion under many sets of accounting principles. Accrued expenses, also known as accrued liabilities, occur when a company incurs an expense it hasn’t yet been billed for. Essentially, the company received a good or service that it will pay for in the future. Accrued revenue occurs when a company has delivered a good or provided a service but hasn’t yet received payment. These accounts are often seen in the cases of long-term projects, milestones, and loans. To offset its complexity, organizations should leverage accounting software that transforms and automates accounting processes.

What Is the Difference Between Cash Basis and Accrual Accounting?

Yes, you should book your income even if it has not been received in cash or check form. By ensuring that the key points of each of these principles and concepts are understood, candidates should be better prepared to answer questions that might arise in the exam. As FA2 only relates to unincorporated businesses (sole traders and partnerships), this might seem like an unrealistic differentiation.

Managing Vacation Accrual: Methods, Calculations, and Policies

They owe $50 to an employee who worked through the month of December (accrued expense). Accrual accounting is encouraged by International Financial Reporting Standards(IFRS) and Generally Accepted Accounting Principles (GAAP). As a result, it has become the standard accounting practice for most companies except for very small businesses and individuals. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Firm of the Future

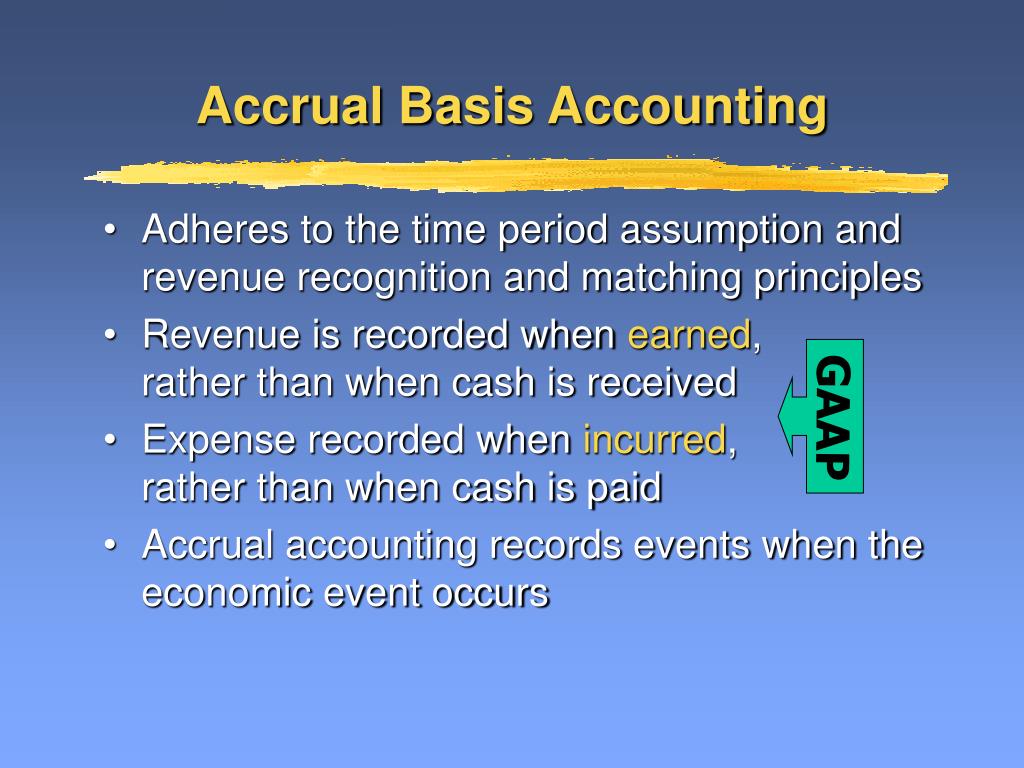

The journal entry would involve a debit to the expense account and a credit to the accounts payable account for accrued expenses. This has the effect of increasing the company’s expenses and accounts payable on its financial statements. The main difference between accrual and cash basis accounting lies in the timing of when revenue and expenses are recognized. The cash method provides an immediate recognition of revenue and expenses, while the accrual method focuses on anticipated revenue and expenses. Accrual is the notion of recognising a cost or income that has been incurred or received but has not yet been shown in the company’s financial statements. Even though payments for some services have not yet been made in full, accruals in the company are important because they ensure that the financial statements of the company accurately represent its financial health.

Accrued Expenses

- However, should you come across a small company using cash-based accounting, it’s definitely something to watch out for.

- Investors can view these as real assets and liabilities instead of unrealized gains their balance sheet.

- If your company needs to purchase raw lumber for $3,000 to build more furniture, you would record the $3,000 as an expense immediately, even if you aren’t able to pay until next week or next month.

- Prudence requires that, whenever such uncertainty exists, preparers of financial statements take a careful approach to the figures and information that they include in the financial statements.

An accountant makes adjustments for revenue that’s been earned but not yet recorded in the general ledger and expenses that have been incurred but are also not yet recorded. An accrual is a record of revenue or expenses that have been earned or incurred but haven’t yet been recorded in the company’s financial statements. This can include things like unpaid invoices for services provided or expenses that have been incurred but not yet paid. This method arose from the increasing complexity of business transactions and a desire for more accurate financial information. Selling on credit and projects that provide revenue streams over a long period affect a company’s financial condition at the time of a transaction. Therefore, it makes sense that such events should also be reflected in the financial statements during the same reporting period that these transactions occur.

She has worked in multiple cities covering breaking news, politics, education, and more. In addition to the purchase of these goods, the business also incurs certain other expenses that are not specifically related to these goods, such as telephone expenses. The accrual principle is often confused with—or treated as only an aspect of—the matching principle. They must not be confused with either income or earnings without proper accounting. The “bottom line” refers to the last figure in the statement of financial position or any profit and loss A/C.

Accrued revenue is any income you expect to receive for any good or service you provided. Accounting principles differ around the world, meaning that it’s not always easy to compare the financial statements of companies from different countries. Privately held companies and nonprofit organizations also may be required by lenders or investors to file GAAP-compliant financial statements. For example, annual audited GAAP financial statements are a common loan covenant required by most banking institutions. Therefore, most companies and organizations in the U.S. comply with GAAP, even though it is not a legal requirement.

Without these rules and standards, publicly traded companies would likely present their financial information in a way that inflates their numbers and makes their trading performance look better than it actually was. If companies were able to pick and choose what information to disclose, it would be extremely unhelpful for investors. Accounting principles are rules and guidelines that companies must abide by when reporting financial data. Which method a company chooses at the outset—or changes to at a later date—must make sound financial sense.

Accrual basis accounting recognizes revenue when the service is provided for the customer even though cash isn’t yet in the bank yet. A profit is noted as soon as a client places an order, and an expense is recorded when a bill arrives or a service is rendered. Under cash accounting, the business only records transactions when an actual movement of cash occurs.

While this can motivate employees to take regular breaks, it may also lead to a rush of vacation requests towards the year’s end, potentially disrupting operations. To mitigate this, companies might set a cap on the number business infographic template of days that can be rolled over, balancing operational efficiency with employee satisfaction. When determining vacation accrual rates, several factors must be considered to ensure equitable and efficient allocation.